WOONSOCKET, R.I. — CVS Health Corporation ("CVS Health", NYSE: CVS) announced today the early results of the previously announced cash tender offers (each, a "Tender Offer" and collectively, the "Tender Offers") for (i) up to $3,000,000,000 aggregate principal amount (the "2023 Notes Maximum Amount") of its 4.000% Senior Notes due 2023 and 3.700% Senior Notes due 2023 and the 2.800% Senior Notes due 2023 issued by its wholly-owned subsidiary, Aetna Inc. (collectively, the "2023 Notes") in the priorities set forth in the first table below (the "2023 Notes Tender Offers") and (ii) up to $3,000,000,000 aggregate principal amount (the "2025 Notes Maximum Amount" and, together with the 2023 Notes Maximum Amount, the "Maximum Amounts") of its 4.100% Senior Notes due 2025 and 3.875% Senior Notes due 2025 (collectively, the "2025 Notes" and, together with the 2023 Notes, the "Notes") in the priorities set forth in the second table below (the "2025 Notes Tender Offers"). Each group of Tender Offers that constitutes either the 2023 Notes Tender Offers or the 2025 Notes Tender Offers is referred to as the "Capped Tender Offers". The sum of the 2023 Notes Maximum Amount and the 2025 Notes Maximum Amount is $6,000,000,000 (the "Aggregate Maximum Amount"), which represents the aggregate principal amount of the Notes subject to the Tender Offers and excludes any Accrued Interest (as defined below) or Early Tender Payment (as defined below). The Tender Offers are being made upon the terms and subject to the conditions set forth in the Offer to Purchase dated August 12, 2020 (as amended or supplemented from time to time, the "Offer to Purchase"), which sets forth a detailed description of the Tender Offers. The Tender Offers are open to all registered holders (individually, a "Holder" and collectively, the "Holders") of the Notes.

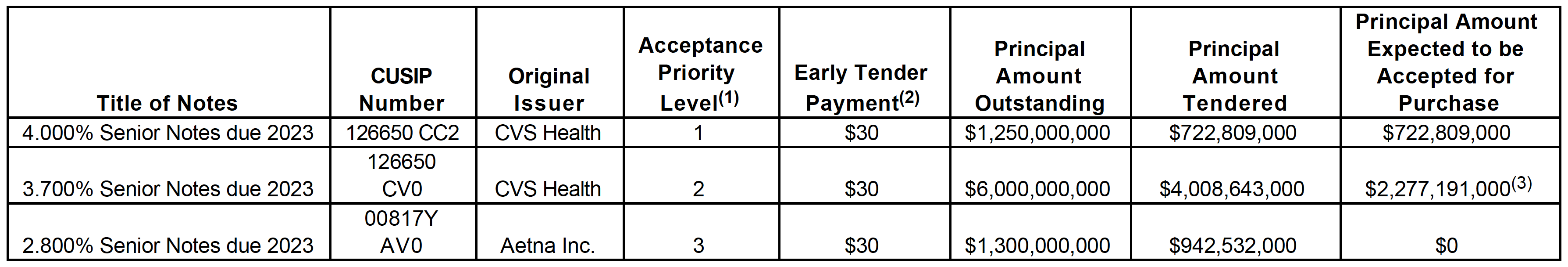

The 2023 Notes Tender Offers

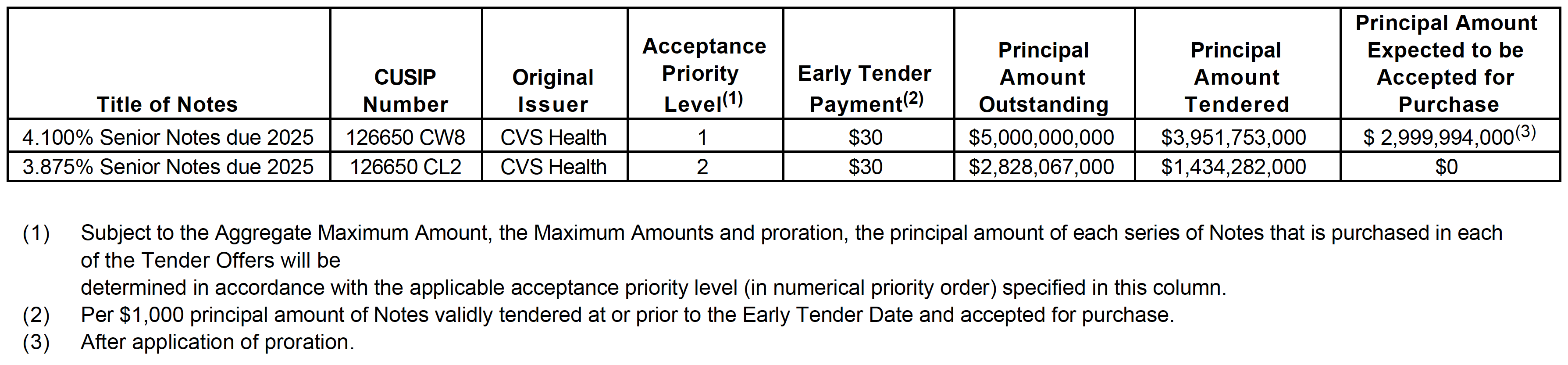

The 2025 Notes Tender Offers

The consideration to be paid in the Tender Offers for each series of Notes validly tendered and expected to be accepted for purchase as described in the Offer to Purchase (the "Total Consideration") will be determined at 9:00 a.m., New York City time, on August 26, 2020.

As of 5:00 p.m., New York City time, on August 25, 2020 (the "Early Tender Date"), as reported by D.F. King & Co., Inc., the Tender and Information Agent for the Tender Offers, the principal amounts of the Notes listed in the tables above have been validly tendered and not validly withdrawn. The Withdrawal Deadline of 5:00 p.m., New York City time, on August 25, 2020 has passed and, accordingly, Notes validly tendered in the Tender Offers may no longer be withdrawn.

CVS Health expects to accept for purchase and make payment for Notes validly tendered and not validly withdrawn at or prior to the Early Tender Date on August 27, 2020 (the "Early Settlement Date"), subject to the acceptance priority levels applicable to the relevant series as described in the Offer to Purchase and, in the case of the 3.700% Senior Notes due 2023 for the 2023 Notes Tender Offers and in the case of the 4.100% Senior Notes due 2025 for the 2025 Notes Tender Offers, to proration as described below.

Because the aggregate principal amount of 2023 Notes validly tendered would exceed the 2023 Notes Maximum Amount, CVS Health expects that it will accept validly tendered 3.700% Senior Notes due 2023 on a prorated basis in accordance with the Offer to Purchase and none of the validly tendered 2.800% Senior Notes due 2023. Because the aggregate principal amount of 2025 Notes validly tendered would exceed the 2025 Notes Maximum Amount, CVS Health expects that it will accept validly tendered 4.100% Senior Notes due 2025 on a prorated basis in accordance with the Offer to Purchase and none of the 3.875% Senior Notes due 2025.

Because CVS Health expects to accept for purchase the Maximum Aggregate Amount of Notes, no additional Notes will be purchased pursuant to the Tender Offers after the Early Settlement Date. As described in the Offer to Purchase, Notes tendered and not accepted for purchase will be promptly returned to the tendering Holder's account.

Holders of all Notes validly tendered and not validly withdrawn at or prior to the Early Tender Date and accepted for purchase are eligible to receive the applicable Total Consideration, which includes the applicable Early Tender Payment of $30 per $1,000 principal amount of Notes tendered at or prior to the Early Tender Date (the "Early Tender Payment"). In addition to the applicable Total Consideration, Holders of Notes accepted for purchase will receive accrued and unpaid interest up to, but not including, the Early Settlement Date ("Accrued Interest").

CVS Health expressly reserves the right, in its sole discretion, subject to applicable law, to terminate the Tender Offers at any time prior to the Expiration Date. The Tender Offers are not conditioned on any minimum principal amount of Notes being tendered but the Tender Offers are subject to certain conditions as described in the Offer to Purchase. Each Tender Offer is a separate offer. The Capped Tender Offers are not conditioned on each other. Each Tender Offer may be individually amended, extended or terminated by CVS Health.

CVS Health has retained Barclays Capital Inc., Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC to act as Dealer Managers for the Tender Offers. D.F. King & Co., Inc. has been retained to act as the Tender and Information Agent for the Tender Offers. Requests for assistance relating to the procedures for tendering Notes may be directed to the Tender and Information Agent either by email at cvs@dfking.com, or by phone (212) 269-5550 (for banks and brokers only) or (800) 714-3305 (for all others toll free). Requests for assistance relating to the terms and conditions of the Tender Offers may be directed to Barclays Capital Inc. at (800) 438-3242 (toll free) or (212) 528-7581 (collect), Goldman Sachs & Co. LLC at (800) 828-3182 (toll free) or (212) 902-6351 (collect) or J.P. Morgan Securities LLC at (866) 834-4666 (toll free) or (212) 834-8553 (collect). Beneficial owners may also contact their broker, dealer, commercial bank, trust company or other nominee for assistance.

This press release does not constitute an offer to sell or purchase, or a solicitation of an offer to sell or purchase, or the solicitation of tenders with respect to, the Notes. No offer, solicitation, purchase or sale will be made in any jurisdiction in which such an offer, solicitation, or sale would be unlawful. The Tender Offers are being made solely pursuant to the Offer to Purchase made available to Holders of the Notes. None of CVS Health, the Dealer Managers, Tender and Information Agent or the trustees with respect to the Notes, or any of their respective affiliates, is making any recommendation as to whether or not Holders should tender or refrain from tendering all or any portion of their Notes in response to the Tender Offers. Holders are urged to evaluate carefully all information in the Offer to Purchase, consult their own investment and tax advisers and make their own decisions whether to tender Notes in the Tender Offers, and, if so, the principal amount of Notes to tender.

About CVS Health

CVS Health employees are united around a common goal of becoming the most consumer-centric health company. We're evolving based on changing consumer needs and meeting people where they are, whether that's in the community at one of our nearly 10,000 local touchpoints, in the home, or in the palm of their hand. Our newest offerings from HealthHUB locations that are redefining what a pharmacy can be, to innovative programs that help manage chronic conditions are designed to create a higher-quality, simpler and more affordable experience. Learn more about how we're transforming health at www.cvshealth.com.

Cautionary Statement Concerning Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by or on behalf of CVS Health Corporation. By their nature, all forward-looking statements are not guarantees of future performance or results and are subject to risks and uncertainties that are difficult to predict and/or quantify. Actual results may differ materially from those contemplated by the forward-looking statements due to the risks and uncertainties related to the COVID-19 pandemic, the geographies impacted and the severity and duration of the pandemic, the pandemic's impact on the U.S. and global economies and consumer behavior and health care utilization patterns, and the timing, scope and impact of stimulus legislation and other federal, state and local governmental responses to the pandemic, as well as the risks and uncertainties described in our Securities and Exchange Commission filings, including those set forth in the Risk Factors section and under the heading "Cautionary Statement Concerning Forward-Looking Statements" in our most recently filed Annual Report on Form 10-K, our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2020 and our recently filed Current Reports on Form 8-K.

You are cautioned not to place undue reliance on CVS Health's forward looking statements. CVS Health's forward-looking statements are and will be based upon management's then-current views and assumptions regarding future events and operating performance, and are applicable only as of the dates of such statements. CVS Health does not assume any duty to update or revise forward-looking statements, whether as a result of new information, future events, uncertainties or otherwise.